The first part of this blog post showed that people who report being in a worse economic situation are more likely to have debts in Georgia. In the second part of this blog post, a new variable is added to the analysis, “Does anyone owe you any money?”

While 46% of the population of Georgia report having debt, only 20% report that someone owes them money. In the latter, group, there are no differences by gender and settlement type, but there are differences by age. People between 36 and 55 years of age are more likely to say that someone owes them money. As seen in the first part of this blog post, people in this age group are also most likely to report they have personal debts.

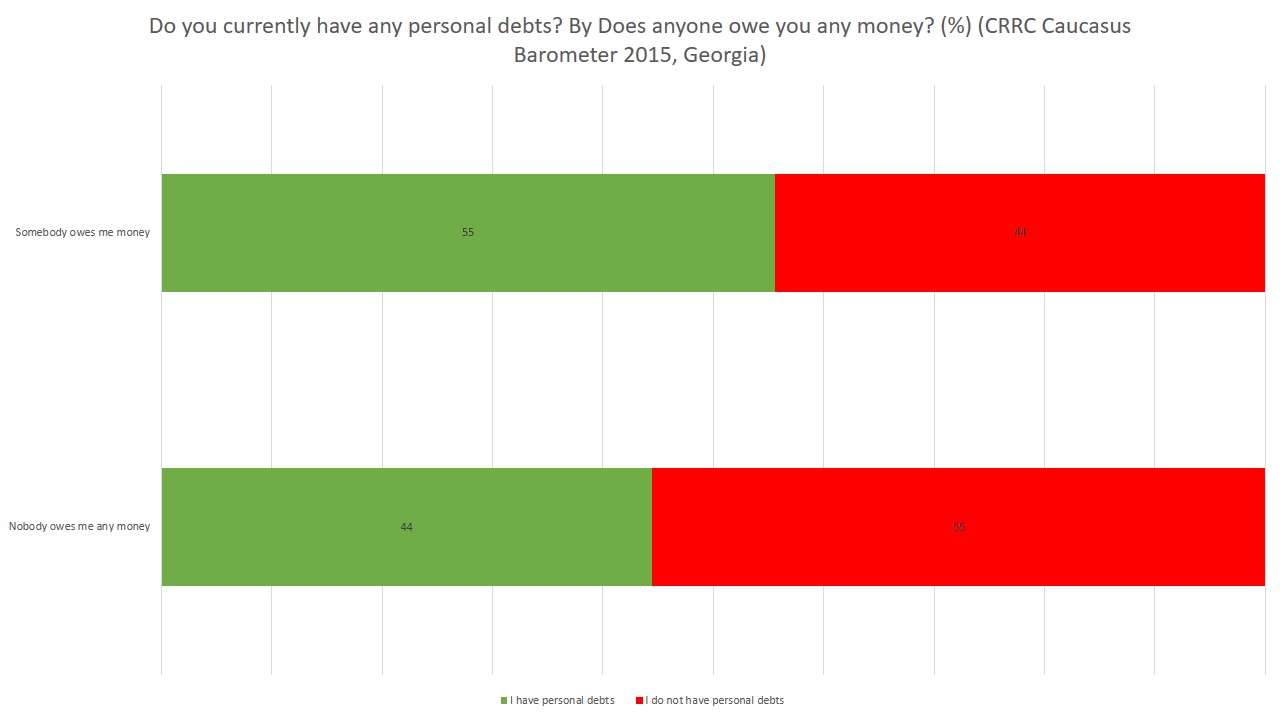

The cross tabulation of the questions about having debt and being owed money shows that people who are owed money are slightly more likely to have debts.

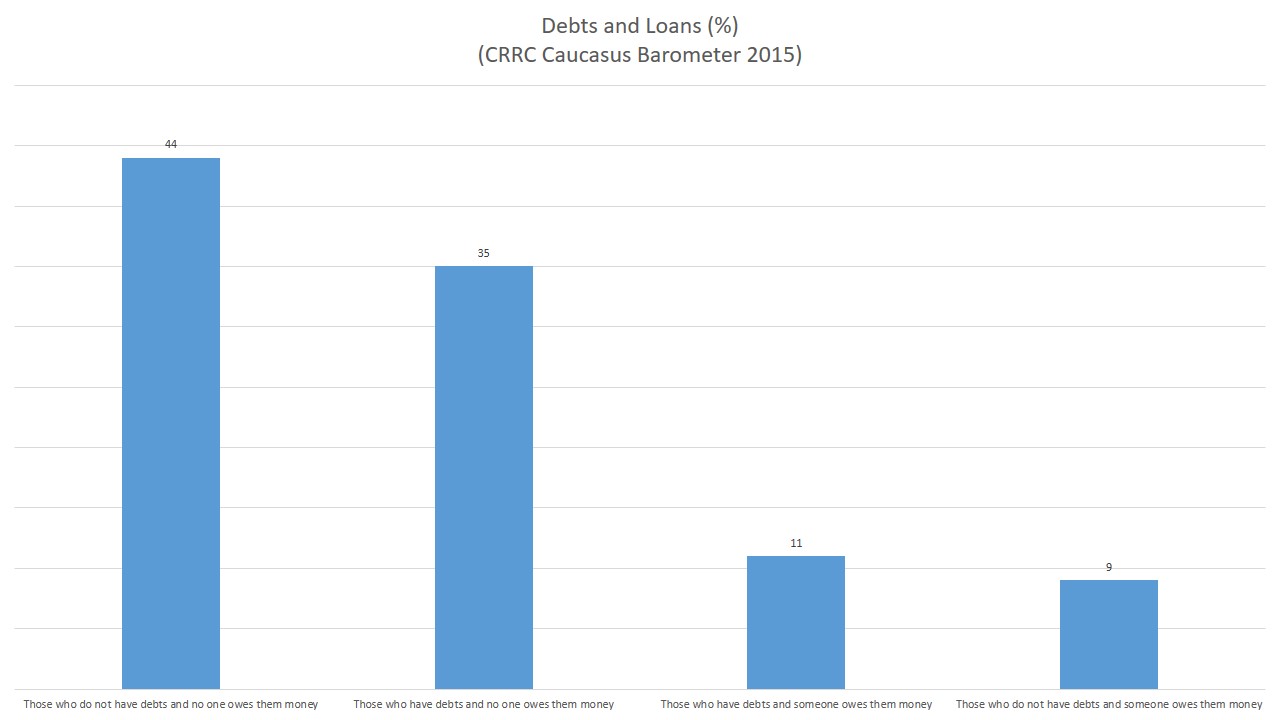

A new variable, “Debts and Loans,” was created to group people into four categories based on the two CB questions discussed above.

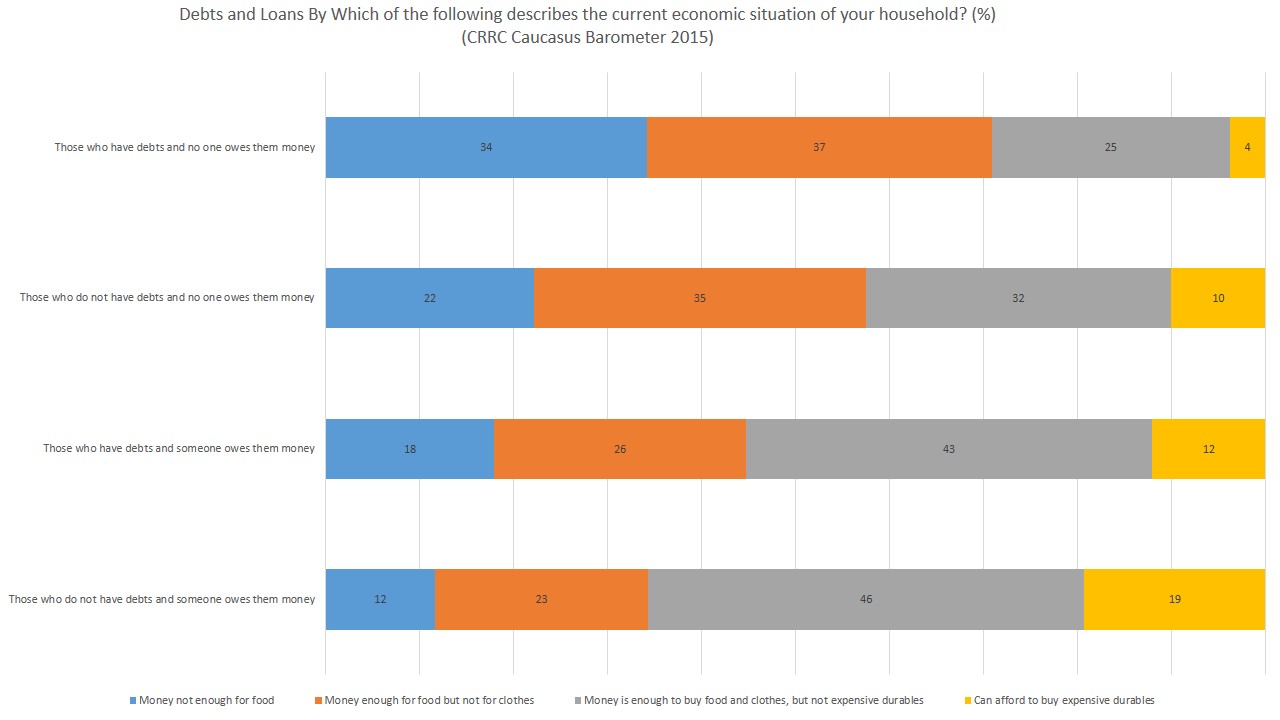

Forty four percent of the population of Georgia are part of the largest group who report neither having debts nor being owed any money. These people are neither better off nor worse off compared to the population on average. The second largest group has debts but no one owes them money. They appear to be in the worst economic situation, with the greatest share of people saying they do not have enough money for food and for clothes in comparison to other groups. The two smallest groups are people who say someone owes them money. The two groups who have no debts appear to be in a relatively good economic situation, with the largest shares of people saying they can afford expensive durables.

Based on the findings presented in both parts of this blog post, debts are approximately twice as common in Georgia as being owed money. Yet, the largest share of the population of the country are those who report neither having debts, nor being owed money.

To look at these issues in more detail, explore the Caucasus Barometer data at CRRC’s Online Data Analysis platform.