Following the world financial crisis of 2007-2008 and the global recession of 2008-2009, GDP growth slowed and unemployment increased in many countries. From a peak of 12.34% GDP growth in 2007, Georgia’s GDP contracted by 3.78% in 2009, leveling out to an average of 6.4% GDP growth over 2010 to 2012. Official unemployment in Georgia also worsened over that period, starting at 13.3% in 2007, peaking at 16.9% in 2009 and falling down to 15% by 2012. However, over the same period of time, GDP per capita in Georgia increased from USD 2,920 in 2008 to USD 3,490 in 2012. Household monetary income and ownership of consumer goods, in particular, have noticeably increased since 2008 in Georgia.

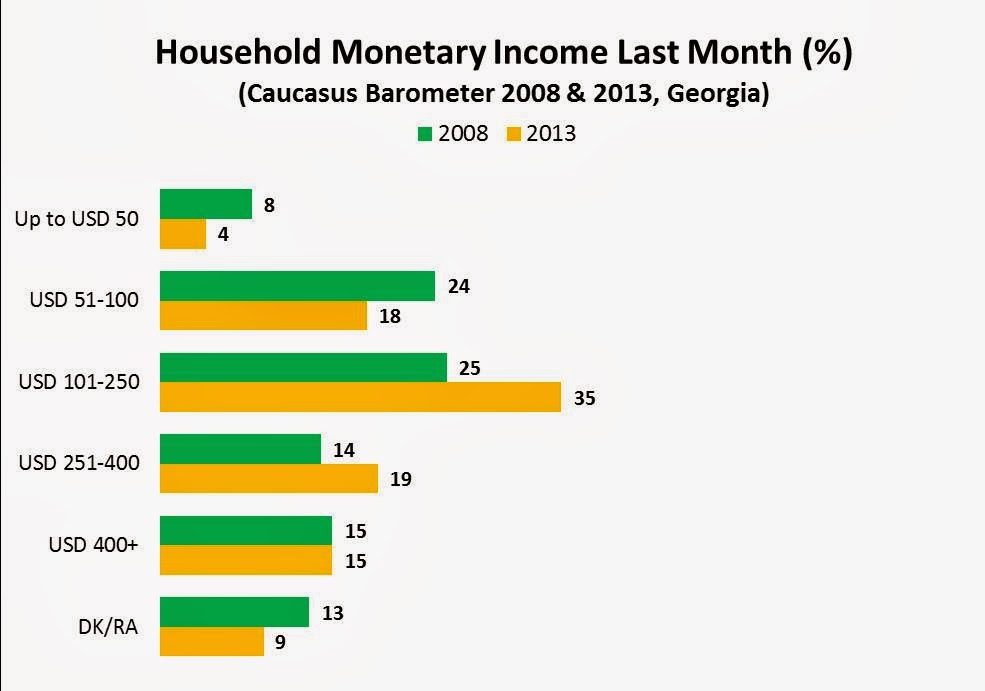

Comparing data from CRRC’s Caucasus Barometer (CB) 2008 and 2013, the percentage of Georgian households earning under USD 100 per month has decreased by 10% since 2008, and 15% more households now earn over USD 100 per month. The greatest decrease occurred in the USD 51-100 bracket (down 6%) and the greatest increase occurred in the USD 101-250 bracket (up 10%) indicating that the greatest shift in income occurred from Georgian households crossing the USD 100 per month threshold. Household income is higher in urban than in rural areas in Georgia; 51% of urban households have monthly incomes of under USD 250, but 72% of rural households do.

Household spending is also up. In 2008, 30% of households spent under USD 100 per month and 54% over USD 100. In 2013, only 18% of households spent under USD 100 per month and 72% spent over USD 100 per month, including 37% that spent over USD 251 per month.

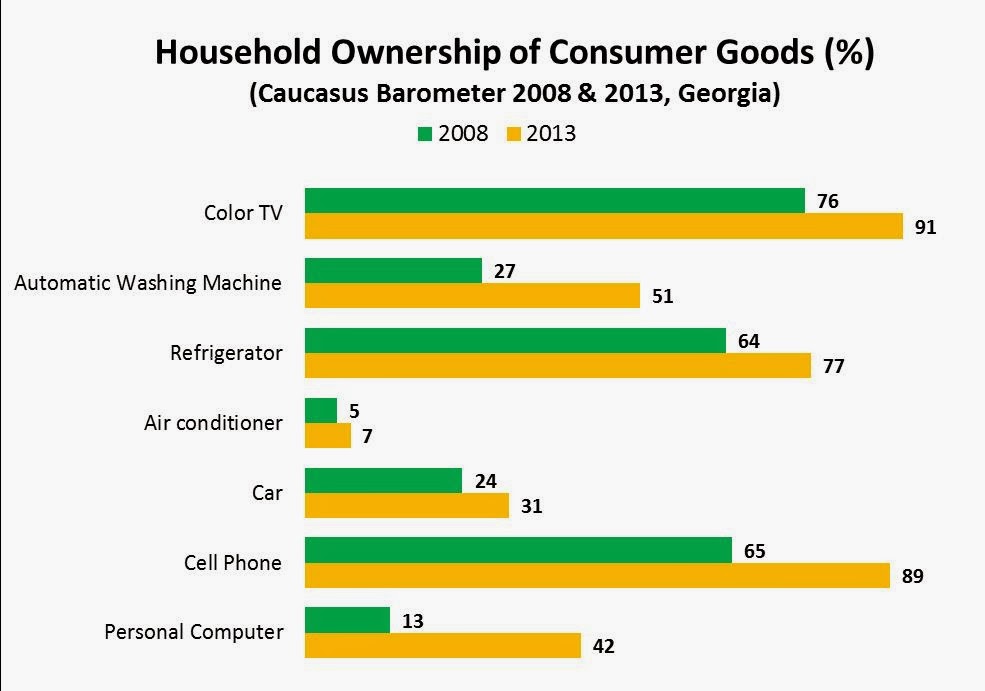

Supporting this income and spending data is the increase in household ownership of consumer goods from 2008 to 2013. The most dramatic increases from 2008 to 2013 have been in automatic washing machine ownership (27% to 51%) and cell phone ownership (65% to 89%). Aside from car ownership, urban household ownership of consumer goods is 10-30% higher than that of rural households, depending on the item in question.

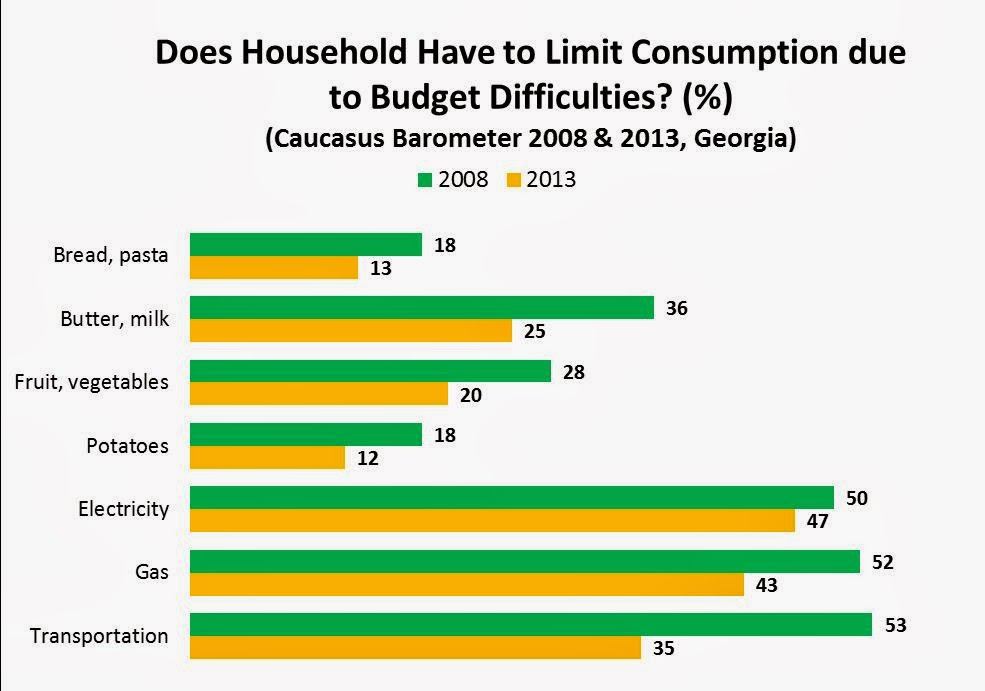

Households have also had to limit their consumption of food, utilities and transportation due to budget difficulties less frequently. Electricity is the only item that appears to have remained constant with respect to households’ need to limit their consumption. There is no statistically significant difference between urban and rural households in their limiting of consumption in the mentioned areas.

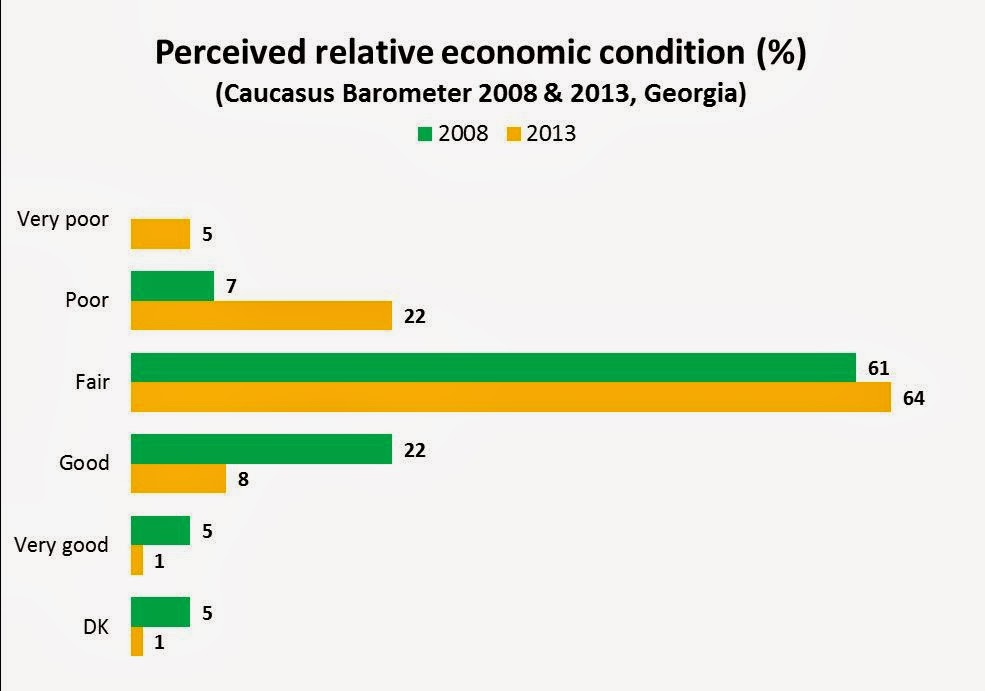

Some indicators have not shifted significantly since 2008. The frequency of households borrowing money for food or utilities has not changed significantly, and the perceived relative economic condition of Georgians has notably decreased since 2008. Also, considerably more Georgians consider themselves poor or very poor relative to other Georgians than they did in 2008.

Only 19% of Georgians believe that up to USD 400 is the minimal monthly income for a normal life, yet 76% of Georgian households earn under USD 400 monthly. However, 61% of Georgians believe that their children will be financially better off at their age, against only 5% viewing their children as the same or worse off. Georgians consider education (28%), the country’s economic situation (16%), and the ability to work hard (15%) to be the three most important factors that will contribute to their children being better off. For more information on income levels in Georgia please view CRRC’s online data analysis tool.